Many people want to leave their assets to their children or family members when they die, and a pension is a tax-efficient way to do this. This is because the majority of pensions are not considered part of a person’s estate so are exempt from inheritance tax. However, there are some scenarios when your loved ones could be required to pay income tax on any money they take from the pension you pass down to them.

The general rules are:

The rules can vary depending on the type of pension you have and the size of your fund. Visit the Gov.uk website or speak with a regulated financial adviser, like Pension Access, to find out what your current pension allows.

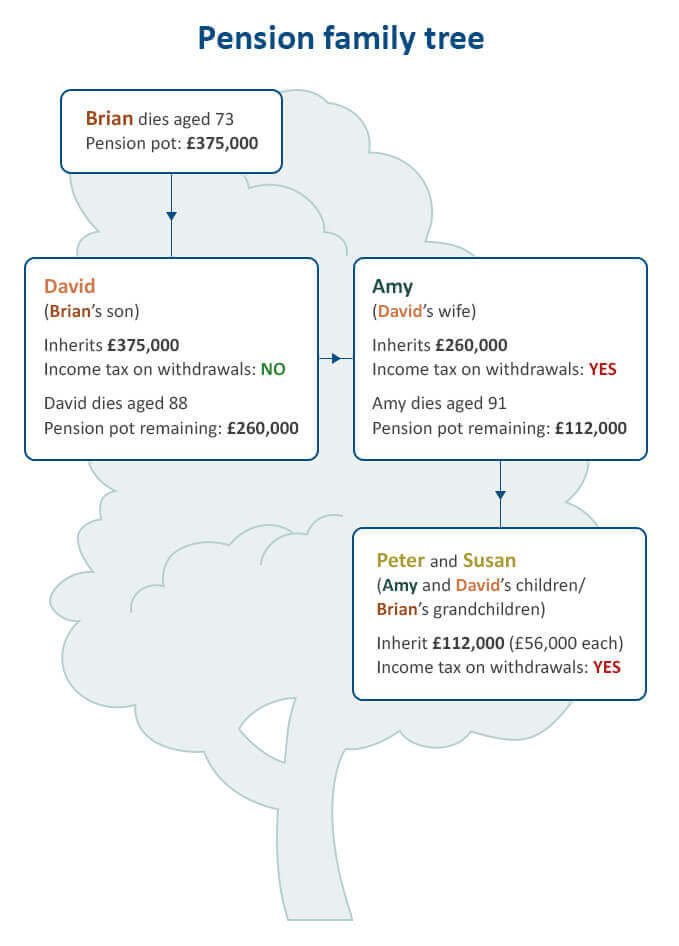

Let’s demonstrate how a fund of £375,000 could be passed down within a family. And we’ll show whether the recipients would pay income tax on any money they withdraw…

For illustrative purposes only

I have a defined contribution scheme

(This covers most personal pensions and many workplace pension schemes)

Whether you are yet to take money from your pension, you’ve taken some of your pension (such as tax-free cash) or you’re in drawdown, the general rules shown above will apply. Make sure you give the contact details of your chosen beneficiaries to your provider. Your pension is not covered by your will, so it is essential that you remember to do this.

I have a defined benefit scheme

(This is usually through an employer and guarantees an income for life from a set age)

A pension from a defined benefit scheme can usually only be paid to a dependant of the person who died, for example a husband, wife, civil partner or child under 23. The general rules shown above will apply. It can sometimes be paid to someone else if the pension scheme’s rules allow it – but it will be taxed at up to 55% as an unauthorised payment.1

I have an annuity

(While an annuity is not a pension, it is a form of retirement income that can be passed on)

You can nominate a beneficiary and pass on the income as long as your annuity is on a joint life basis or if it has a guarantee period. The general rules shown above will apply.

You can take all of the money at once as a lump sum, receive regular sums such as monthly payments or make one-off withdrawals as and when you need. Remember: if the owner of the pension you have inherited was over 75 when they died, you will pay income tax on the money you withdraw at your highest marginal rate.

You cannot add an inherited pension into an existing pension scheme. You can however transfer the pension to a different scheme of your choice. Such as one with better performance or less charges.

Unlike your own personal pension, you do not have to wait until you are 55 to withdraw a pension you have inherited.

A pension that is inherited does not count towards your annual personal allowance (the amount you can pay into your pension each year without paying tax).

Of course, no one knows exactly when they are going to die. What you can do now is check what your current pension offers you and your family. It’s also a good idea to check whether your retirement savings are properly tailored to you, and that you’re maximising your pension savings. So, there could be more in the pot not only for your future, but your children and loved ones too.

1Gov.uk: Tax on a private pension you inherit

We can help you to make the best possible decisions when it comes to your pension.

Taking pension money early is not right for everyone as it will leave you worse off in retirement. Also, tax treatment depends on your circumstances and is subject to change. That’s why it makes sense to get help from a regulated specialist.