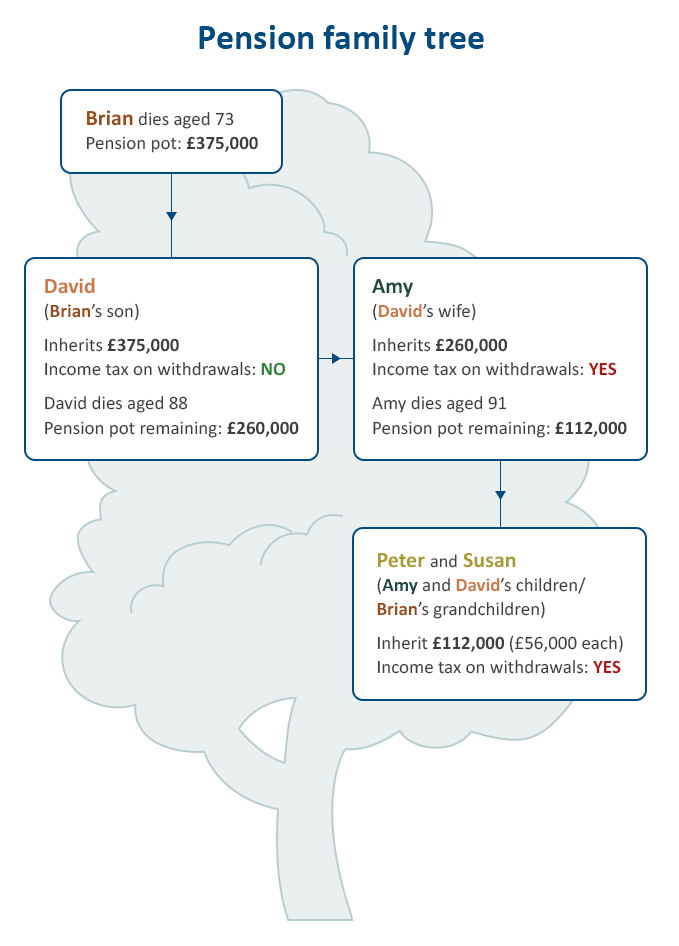

The new pension rules have made it possible to leave your fund to any beneficiary, including a child, without paying a 55% ‘death tax’.

Many people want to leave their assets to their family when they pass, and a pension is now a tax-efficient way to do this. They are not considered part of a person’s estate so are exempt from inheritance tax. Prior to the recent changes, a death tax of up to 55% was applied instead. Now, with the abolishment of the death tax, pensions could be effective vehicles for leaving money to beneficiaries.

Note, that tax treatment depends on your individual circumstances and may be subject to change. The new tax rules are:

Another new change is the flexibility to leave your fund to whoever you wish. Prior to the reforms you could only leave it to someone who was financially dependent on you, such as a child or spouse, but now you can choose anyone to be a beneficiary.

The world of pensions can be complex enough when just considering what is best for yourself – let alone your family. A financial adviser can help you review your pension’s performance; features which may or may not affect its accessibility to your loved ones; and the most appropriate options open to you when the time comes to access your pot. If you wish to consider pension transfer (pension switch) they will also walk you through your options.

The details provided in this article are for general information only and are in no way deemed to be financial advice. All of the material is correct as of the publication date, but could be out-of-date by the time you read the article.

We can help you to make the best possible decisions when it comes to your pension.

Taking pension money early is not right for everyone as it will leave you worse off in retirement. Also, tax treatment depends on your circumstances and is subject to change. That’s why it makes sense to get help from a regulated specialist.