Not all pensions are the same. Modern, properly tailored schemes will generally out-perform old, unmanaged plans. And pension performance matters because it affects how much money you will have in your pot when you need it. More money generally means more options and more freedom when it comes to your retirement plans.

There are three key factors that will affect the performance of your pension:

Before we even look at how your pension savings are invested, it’s worth quickly covering why they are invested in the first place. The easiest way to look at this is to begin with inflation.

Basically, over time, things become more expensive and this devalues money. Just think what you could have bought at the supermarket with a tenner 20 years ago…and how far it will stretch now.

So, one of the fundamental ideas behind investing your savings is to match or beat inflation. That way any money you put away will, at the very least, have the same purchasing power when you finally need to use it. And if your savings beat inflation over time then you will effectively have more money than you saved.

While inflation goes up and down all the time, a good starting point is to target investment growth of at least 2.5% per year to match inflation. And a tailored and properly-managed pension is one of the best savings tools we have, to at least match and beat inflation. Much more so than a savings account and most ISAs.

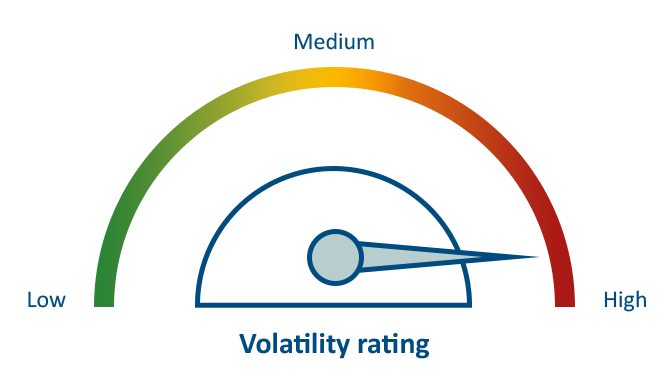

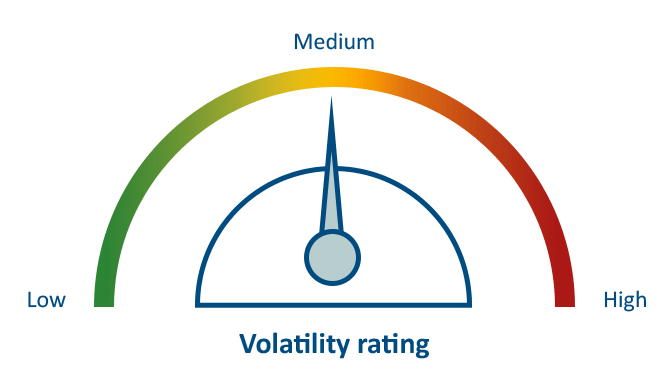

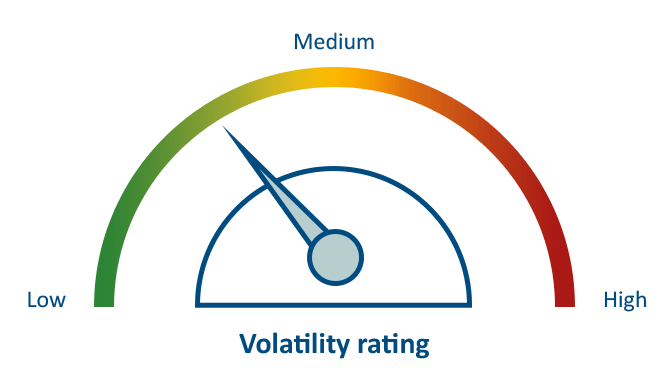

There are three main categories of pension investments. We’ve given each one a volatility rating, which refers to how much the value of your savings could go up and down in the short term. Higher volatility means a greater potential for growth but also a greater risk that your savings will not grow, and you could end up getting back less money than you put in.

Your savings are used to buy shares in companies listed on one of the many stock exchanges throughout the world. The value of your savings then goes up and down depending on the share price for those companies. Plus, the companies you invest in will often pay you dividends. This is a share of the profits and means your investments can still be earning you money even if share prices are not doing so well.

Bricks and mortar (usually commercial property) is another way to invest your savings. The potential growth in your investments comes from a rise in the value of the property or from rental income. For example, your money could be invested in an office block that is rented out. Commercial property investments tend to be less risky than stocks and shares but often riskier than bonds.

When you invest in a bond you are essentially loaning your savings to governments and corporations. Your investment growth comes from the interest paid on these loans. The interest rate is either fixed or variable and different types of bonds come with different levels of risk. While the returns you get from a bond are potentially lower than with shares or property investments, the associated risks are also lower.

There are other types of investments. Although, when it comes to regulated pensions, it is unlikely that the make-up of your investments will stray too far from these three main categories.

Putting all your pension savings into volatile investments potentially increases the returns you could get. But it also significantly increases the risk. And the amount of risk we are willing to take with investments is very personal. That’s why pension performance is not about aiming for the best returns. Instead, it’s about tailoring your investments to your specific needs.

Let’s say all your investments are in high-risk shares. Performance is looking great until suddenly, two months before you are due to retire, the stock market collapses and the value of your pension plummets.

All that great performance means nothing if you have to work for another five years to see if your savings will regain their value. Or, you could choose to retire on a lot less money than you had originally planned for.

This isn’t a nice choice for anyone to have to make. So, by making sure your pension is properly managed and therefore tailored to your needs, you can avoid being in this position.

We can help you to make the best possible decisions when it comes to your pension.

Taking pension money early is not right for everyone as it will leave you worse off in retirement. Also, tax treatment depends on your circumstances and is subject to change. That’s why it makes sense to get help from a regulated specialist.